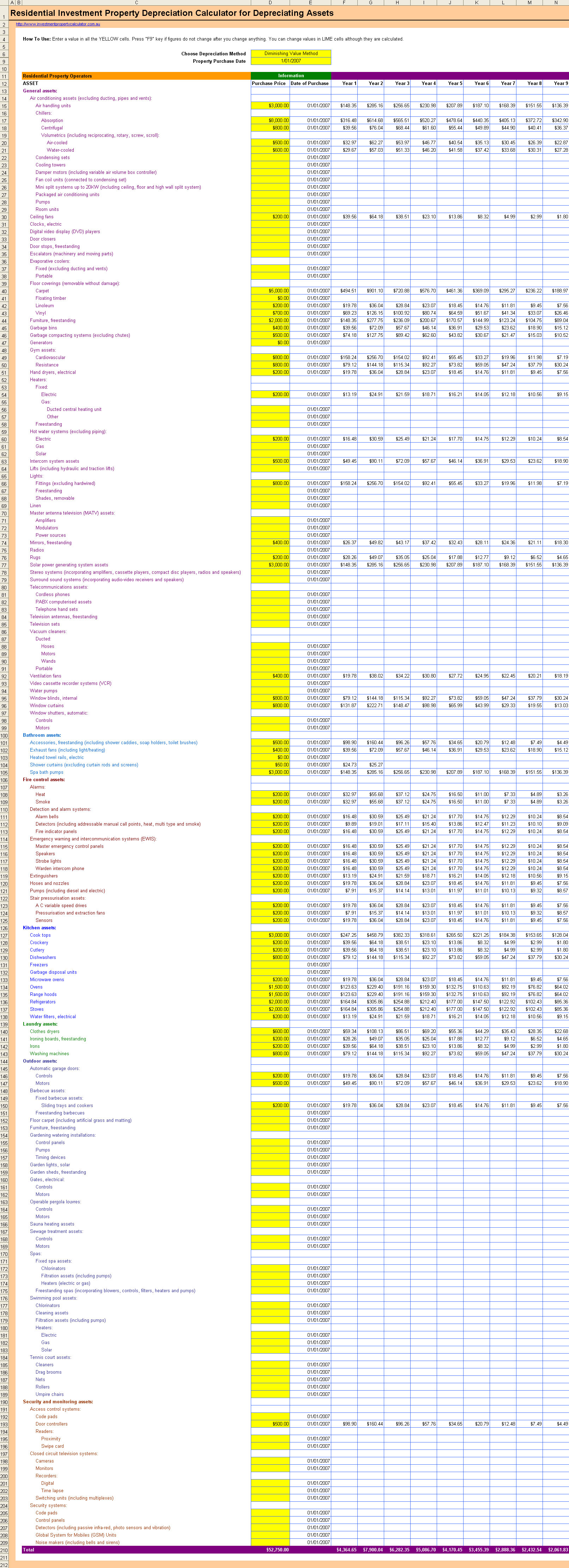

Rental property depreciation calculator

Be sure to enter the number of fair rental and personal-use days on line 2. 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 275-year residential rental property and 39-year nonresidential real.

Macrs Depreciation Calculator Straight Line Double Declining

List your total income expenses and depreciation for each rental property.

. With many reputable quantity surveying companies offering a money-back guarantee and fees that are 100 tax deductible you have nothing to lose and. Appliance depreciation When offering a rental landlords often install dishwashers washing machines air conditioners stoves and other assets. Then it automatically calculates depreciation for either residential or commercial rental properties based on the users choice.

The cost of preparing your depreciation report will vary depending on the type of property purchased where its located its size and other factors. Depreciation recapture a provision the IRS uses to tax the profitable sale of a rental property on which the owner has previously claimed depreciation can have a great impact on an investors bottom line. You didnt claim depreciation in prior years on a depreciable asset.

Calculate Property Depreciation With Property Depreciation Calculator. Thats not the case for your primary residence in which repairs. Property depreciation for real estate related to.

Sum-of-Years Digits Depreciation Calculator. The results will display the minimum and maximum depreciation deductions that may be available for your investment property between 1 and 5 full years. To determine the amount youll be taxed on your depreciation recapture use our depreciation recapture tax calculator.

A financial model for rental property that you can stand behind. Rental Property Depreciation - This article describes how rental property depreciation works and why it. It may be a good investment.

Just like the building itself these appliances decline in value and landlords can claim this depreciation over several years usually in line with each assets effective life. Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. Residential rental property is depreciated at a rate of 3636 each.

They were being depreciated with a useful life for. However dont let costs deter you. Read more about rental property depreciation before writing it off and use our rental property depreciation calculator to make your life easier.

Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Claiming catch-up depreciation is a change in the accounting method. I inherited a rental property that was being depreciated.

The MACRS Depreciation Calculator allows you to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. Depreciation commences as soon as the property is placed in service or available to use as a rental. Calculate Rental Income to Find.

The calculations are as follows. But what about the other assets. Rental Property Calculator - This rental property calculator lets you enter all your financial projections.

I believe I must start depreciating the property itself for 275 years SL using the net FMV of the building at the date I inherited it as the basis. Asset value - The original value of the asset for which you are calculating depreciation. Now we are armed with the two components of the formula and we can plug these numbers directly into the formula to calculate gross rental yield.

So the property you want to invest in earns a gross rental yield of 324 which is slightly higher than the property you currently own. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property.

If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. The Short Term Loan Shops rental property calculator can determine the cash on cash return and the cap rate for a potential investment property. Real Estate Property Depreciation Calculator.

If you dont want to crunch numbers manually use a rental property calculator to determine rental income. If you have more than three rental or royalty properties complete and attach as many Schedules E as are needed to separately list all of the properties. You just need to input all the numbers and the calculator will provide you with a detailed breakdown of rental income property expenses and ROI.

Period - The estimated useful life span or life expectancy of an asset. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. This is known as depreciation recapture which is specific to rental properties and the amount previously taken as a depreciation deduction is taxed at a recapture rate of 25.

A great rental property calculator takes the guesswork out of forecasting your cash flow and makes it much easier to grow a profitable portfolio. It and its new floor coverings and appliances have been depreciated for 2 tax years. Basic repairs and maintenance such as new paint and new carpets are deductible for your rental properties.

The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. However fill in lines 23a through 26. Use a Rental Property Calculator.

Catch-up depreciation is an adjustment to correct improper depreciation. By convention most US. You claimed more or less than the allowable depreciation on a depreciable asset.

Final value residual value - The expected final market value after the useful life of the asset. In this article Im going to give you one of the most important tools in any real estate investors toolbox. In many cases the seller will only provide a short list of operating expenses and earnings like utilities and gross annual income for you to look over before you decide to make a deal.

This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20. Below is the explanation of the values that are required to add to the calculator for calculation.

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Template For Straight Line And Declining Balance

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Macrs Depreciation Calculator With Formula Nerd Counter

How Depreciation Claiming Boosts Property Cash Flow

Depreciation For Rental Property How To Calculate

How To Use Rental Property Depreciation To Your Advantage

A Guide To Property Depreciation And How Much You Can Save

How Is Property Depreciation Calculated Rent Blog

Rental Property Depreciation Rules Schedule Recapture

Straight Line Depreciation Calculator And Definition Retipster

Straight Line Depreciation Calculator And Definition Retipster

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Rental Property Depreciation Rules Schedule Recapture

Free Investment Property Depreciation Calculator